Business Insurance in and around Atlanta

Get your Atlanta business covered, right here!

No funny business here

Help Prepare Your Business For The Unexpected.

The unexpected happens. It's always better to be prepared for the unfortunate catastrophe, like a staff member getting hurt on your business's property.

Get your Atlanta business covered, right here!

No funny business here

Strictly Business With State Farm

Protecting your business from these potential problems is as easy as choosing State Farm. With this small business insurance, agent Clint Raines can not only help you devise a policy that will fit your needs, but can also help you submit a claim should a problem like this arise.

Do what's right for your business, your employees, and your customers by reaching out to State Farm agent Clint Raines today to explore your business insurance options!

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

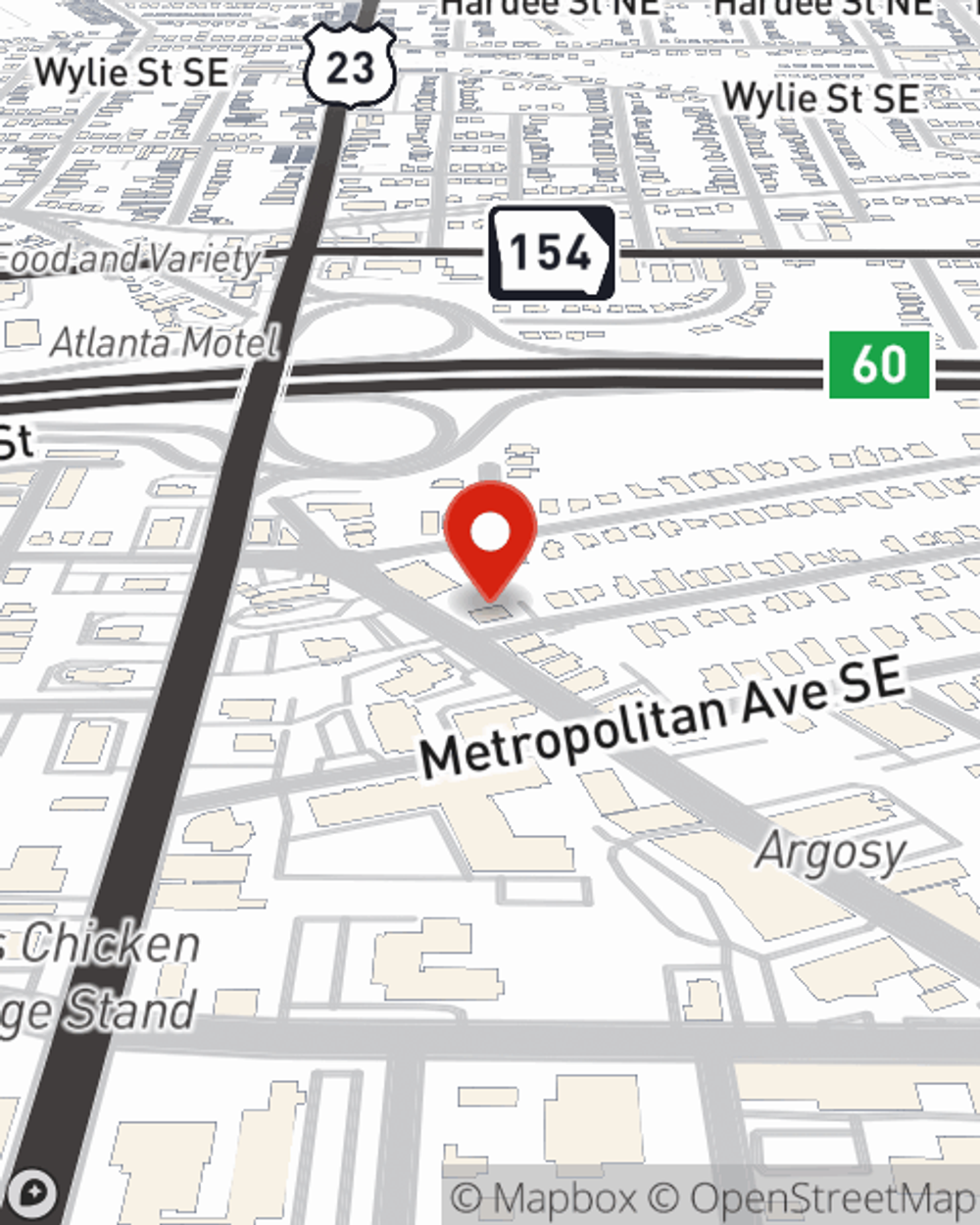

Clint Raines

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".